30 year mortgage calculator with pmi

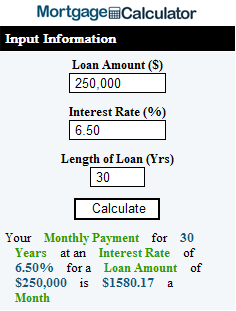

With a fixed-rate loan the interest rate remains the same for the entire span of the mortgage. 30-Year Fixed Mortgage Principal Loan Amount.

Mortgage Calculator Script Free Mortgage Calculator Widget

That means if 150000 was borrowed and the annual premiums cost 1 the borrower would have to pay 1500 each year 125 per month to insurance their mortgage.

. Mortgage Insurance PMI Taxes Other Fees. Private Mortgage Insurance PMI. Extra Payment Loan Types and Points.

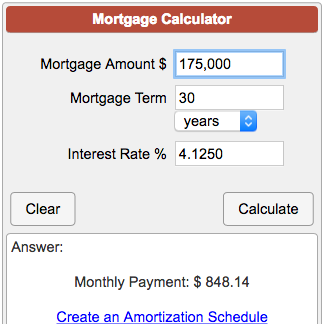

Not only that there is a complete amortization schedule up to the final year of payment. Fixed-rate loans provide a stable monthly mortgage payment so you can create a steady budget. A 30-year fixed-rate loan will give you the lowest payment compared to other shorter-term loans.

You can also use the calculator on top to estimate extra payments you make once a year. Paying loan off faster vs 30-year loans. It also calculates the sum total of all payments including one-time down.

In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. With 20 down you can eliminate the need for any PMI. Make a bigger down payment.

Use SmartAssets free California mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. A 30-year fixed-rate home loan is a mortgage that will be completely paid off in 30 years if all the payments are made as scheduled. If you only.

Mortgage rates have been falling more or less steadily since 1981 when average mortgage rates topped out at over 18 APR. Perfect if you are in search of a reliable fast and intuitive free mortgage calculator with taxes mortgage calculator with PMI. Try different scenarios on our mortgage calculator but some ways to reduce your mortgage payment are as follows.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. You can adjust your monthly. 30-year fixed-rate mortgage lower your monthly payment but youll pay more interest over the life of the loan.

Filters enable you to change the loan amount duration or loan type. Choose a longer-term mortgage like a 30-year rather than a 15-year loan. Unlike adjustable-rate mortgages there are no surprises with fixed-rate loans and you dont have to worry about your rate re-setting or your payment increasing.

Mortgages are how most people are able to own. Comparing the 15-Year Loan and the 30-Year Loan. Your principal and interest payments will drop with a smaller loan amount and youll reduce your PMI expenses.

Try to avoid PMI private mortgage insurance if you can. For most conventional loans youre required to pay for private mortgage insurance PMI along with your monthly mortgage payment until your loan-to-value LTV reaches 78-80. For example a 30-year fixed-rate loan will have 360 monthly mortgage payments 30x12360 This formula will come in handy when determining how much home you can afford.

Additionally the amortization schedule can be set to monthly or yearly. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. How much money could you save.

For instance if you take out a 30-year mortgage that means youll make a monthly payment for 30 years. If you can afford it consider taking a 15-year mortgage over a 30-year term. The loan term is the length of your mortgage.

Consider an adjustable-rate mortgage. For example lets compare interest costs between a 30-year fixed mortgage and 15-year fixed mortgage with a lower interest rate. Put 20 down or as much as you can for your down payment.

By default 250000 30-yr fixed-rate loans are displayed in the table below. Lock-in Redmonds Low 30-Year Mortgage Rates Today. When talking about a 30-year fixed-rate mortgage it typically refers to conventional loans.

A 15-year fixed-rate mortgage reduce the total interest youll pay but your. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. The average interest rate on a 30-year fixed-rate mortgage was 267 APR on Dec.

Once the loan term is up your mortgage should be paid off. 30-year fixed is the most common mortgage type. Todays mortgage rates in California are 5767 for a 30-year fixed 5119 for a 15-year fixed and 5198 for a 5-year adjustable-rate mortgage ARM.

To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top. Mortgage loan terms can vary but most borrowers choose either a fixed-rate 15-year or 30-year mortgage. Thats the lowest average rate since at least 1971 the Federal Reserves earliest published rate.

Estimate the cost of 30 year fixed and 15 year fixed mortgages. Getting ready to buy a home. The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan.

Improve your credit score. Regardless of the value of a home most mortgage insurance premiums cost between 05 and as much as 5 of the original amount of a mortgage loan per year. PMI year Amortization Period.

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Calculator App

Mortgage Calculator Design Calculator Design Mortgage Calculator Mortgage

How Much Is Pmi Insurance Private Mortgage Insurance Pmi Insurance Mortgage

Calculator For Mortgage Shop 56 Off Www Wtashows Com

Calculate My Mortgage Sale 59 Off Www Ingeniovirtual Com

Downloadable Free Mortgage Calculator Tool

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

15 Year Vs 30 Year Mortgage 30 Year Mortgage Money Management Mortgage Payment

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Mortgage Affordability Calculator How Much House Can I Afford Mortgage Payment Calculator Mortgage Free Mortgage Calculator

Nationwide Commercial Mortgage Lenders Mortgage Amortization Amortization Schedule Mortgage Amortization Calculator

Mortgage Calculator Mortgage Calculator Mortgage Amortization Schedule

15 Year Vs 30 Year Mortgage Calculator Calculate Current 15yr Frm Or 30yr Monthly Fixed Rate Mortgage Refinance Payments

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Mortgage Payment Calculator Mortgage Calculator Mortgage

Downloadable Free Mortgage Calculator Tool